Thomson Reuters

- The Fed is "carefully" watching the housing market as huge demand sends prices soaring, Chair Jerome Powell said.

- The central bank doesn't see "the kind of financial stability concerns" that fueled the 2008 crash, he added.

- Powell said he hopes homebuilders react "and come up with more supply," which would also boost job growth.

- See more stories on Insider's business page.

The housing market boom has caught the Federal Reserve's attention.

By several measures, the US housing market is running at its hottest level since the mid-2000s bubble that nearly crashed the global financial system. Prices have surged at decade-high rates, and homebuying, while slowed from recent highs, remains elevated. What began as a pandemic-era rally has since raised concerns that soaring prices are eroding home affordability just as the US economy rebounds.

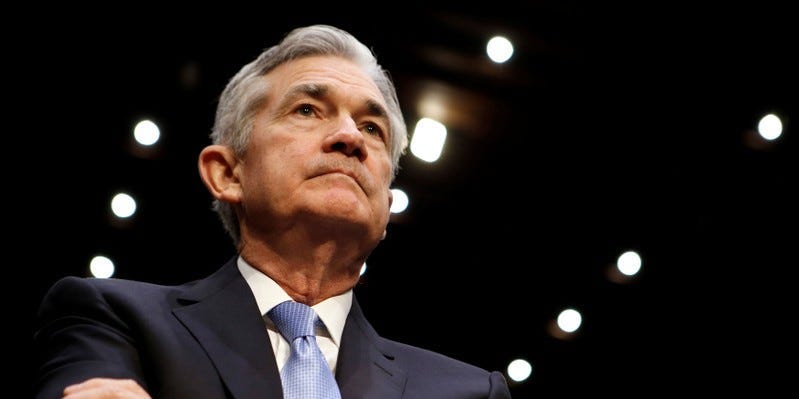

The market frenzy is being "carefully" monitored by the Fed, but there's little reason to fear another nationwide crash, Fed Chair Jerome Powell said in a Wednesday press conference. The subprime lending and speculative purchasing that fueled the 2008 meltdown aren't nearly as abundant this time around, making for a "very different housing market" than that seen a little over a decade ago, he added.

"I don't see the kind of financial stability concerns that really do reside around the housing sector," Powell said. "We don't see bad loans and unsustainable prices and that kind of thing."

Much of the boom is driven by demand significantly outstripping supply. Home inventory sits near record lows, and while housing starts recently leaped to the fastest rate since 2006, it will take some time for construction to equate to new supply.

Powell acknowledged the imbalance and highlighted that a bounceback in supply could also serve the labor market's recovery.

"My hope would be that over time, housing builders can react to this demand and come up with more supply, and workers will come back to work in that industry," he said.

Some of the current market strains can be tied directly to fallout from the 2008 crisis. The intense homebuying activity seen throughout the 2000s drove a boom in new construction. The rally lasted for years until dubious lending brought the market toppling down. Construction came to an almost-complete stop, and while it trended higher through the 2010s, it failed to retake levels seen during the prior decade's surge. That building deficit is just now coming back to bite prospective homebuyers.

"We've been underbuilding for years," Gay Cororaton, director of housing and commercial research for the National Association of Realtors (NAR), told Insider's Hillary Hoffower.

While the Federal Reserve has little direct influence on the housing market, the central bank's promise to hold interest rates near zero for the foreseeable future places downward pressure on mortgage rates. Lower borrowing costs help lower the barrier to entry for potential buyers, as would the previewed jump in supply.

Signs point to demand holding up even as supply recovers. Nearly 9% of Americans plan to buy a home in the next six months, according to The Conference Board's latest consumer confidence report. That's the largest share since 1987.